Why dairy farms are at record values

Whilst the average Australian farm is valued at around $10,000 per hectare, the median price of dairy farming land is more than double that, at $24,000 per hectare.

Dairy farmland prices have increased by 20% since 2020.

What’s driving up the value of dairy land in Australia?

Strong commodity prices

Global demand for dairy products is climbing and predicted to continue in the year ahead. Higher demand means higher prices, which make dairying more profitable and more attractive. This pushes up demand for dairying land.

Scarcity of land

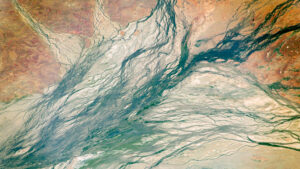

Only 10% of Australia is arable. If the land can’t support crops or grasses, it can’t support grazing. Dairy farming requires reliable rainfall, which further reduces the area of suitable land. The bulk of the country’s milk production comes from the higher rainfall areas of Victoria, New South Wales and Tasmania. The industry can’t expand geographically, so available land becomes more valuable.

Good rainfall

The last drought to affect Australia’s dairy industry was from 2017 to 2019. It was the driest 3-year period on record for New South Wales. Feed was limited. Water was expensive. Farmers had to reduce the number of cows. And each cow produced on average 8% less milk.

Since that drought, rainfall in dairying regions has been good. Production has increased. Profits have increased, thanks to that global demand and higher prices. Demand for dairy farms has increased, pushing up land values.

Stable interest rates

Interest rate volatility impacts dairy farm values. Fewer people are prepared to borrow with uncertainty about interest rates.

However, interest rates have stabilised. People can borrow with more confidence. There are more people in the market for the limited dairy farming land available.

International investors

30% of Australia’s dairy output is exported. Australia has a reputation for quality dairy produce, hence the high global demand.

Demand for our dairy products has translated to demand for our dairy farms. About 12% of our farms are now foreign owned. Almost 80% of our dairy processing facilities are owned by foreign companies.

With foreign companies looking to buy limited dairy land, it’s not surprising that this too pushes up land values.

Local investors

Agriculture hasn’t always been an attractive investment. However, that’s not true today. The conditions described above – high demand, better profits and high land values – make farms appealing to investors. Because dairy farms are increasing in value much higher than average, it’s natural that they attract the attention of investors.

The value of farmland can drive business performance and growth. It plays a key role in the financial portfolios of Australian farmers and farm investors.

Dairy farming in Australia has come a long way from the dark days of artificially low retail milk prices. Coles’ campaign to set the retail price of milk at $1 a litre came close to wiping out many farmers.

Dairying today is valued for the essential industry that it is. Dairy land will continue to be in high demand. So too, the dairy products that come off that land.

One of the reasons we started IIF is to boost the appreciation and value of our farmers.

If you’d like a chance to invest in the produce coming off Australia’s farms, sign up as a member of the Invest in Farming Co-operative. You can do that here.