The lengths retirees will go to earn more

When Trevor and Rita Duncan retired ten years ago, they did so with enough savings to live comfortably off investment interest. Or so they thought.

What they hadn’t considered was that we’d enter an extended period of unprecedented low interest rates. Month on month, the Reserve Bank dropped official rates. From 4.25% in 2012, to a record low of 0.1%.

With each drop, returns on the Duncans’ investments were dragged lower and lower. Where they had been earning 10% p.a. from their fixed interest investments, they were now earning less than half that.

They considered options. They rejected them. Trevor and Rita simply weren’t prepared to take the extra risk that seemed to go hand-in-hand with higher potential returns.

Still, their interest in earning more interest was piqued.

It was at this time that the Duncans learnt of IIF – Invest Inya Farmer – from their daughter Jo.

Jo showed them the IIF app, showed them how she had invested in a few Australian farmers, and showed them the money she had earnt when that produce went to market.

In one case, Jo got a return in four months – the equivalent of 15% p.a. That kind of return was miles away from what Trevor and Rita were currently getting.

Coming from a farming family, Trevor understood that there are risks in farming. However, he and Rita were excited to be able to support farmers.

Because the IIF app allowed them to diversify, they figured that they could minimise any risk from a freak storm or a plague.

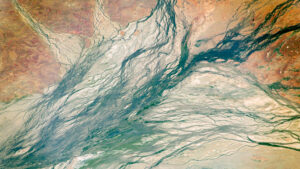

Trevor and Rita not only diversified the produce they invested in, but they spread their investments all over the country – just because they could. From the Northern Territory to Tasmania, from South Australia to FNQ.

Whenever they got news of a new IIF offering, they’d do a bit of research – often without leaving the IIF app which includes backgrounds on produce, growing cycles and farmer profiles. This research uncovered some surprises. For example, they learnt that Sydney rock oysters grown much slower than Pacific oysters, basically because they are fussier eaters than the Pacifics.

Sometimes a farm is located in a part of the country the Duncans don’t know. (This surprises them because they reckon they’ve travelled everywhere.) They can see exactly where a farm is located on a detailed map. When they invested in grapes, they could see what row of vines they had invested in!

Some things have changed since Rita and Trevor joined the IIF Coop and started investing. Recently, in an effort to slow sudden inflation, the Reserve Bank raised rates. That means that returns on fixed investments also rose. Retirees like Trevor and Rita could breathe a sigh of relief.

And yet, Trevor and Rita are hooked on IIF. The outlay is small, the returns have been really good and the outcomes fast. The highlights? Being able to invest in something real, tangible – and edible. That, and being able to watch everything on an app on their phone.

Photo by Tyler Farmer on Unsplash