Farm with the direct support of the people who consume your food or fibre.

IIF is a world-first approach to investing in agriculture that brings farmers and consumers closer together.

It gives best-practice farmers (like you!) early access to capital so you can improve cashflow, minimise risk, and pursue opportunities that would otherwise be out of reach.

IIF does not invest in your business or land. We are not a loan provider or a line of credit. We invest in what your farm produces eg: cattle, crops, fruit, or vegetables, one season at a time.

Click on the sector that best matches your farm below to see how we’ve helped others just like you

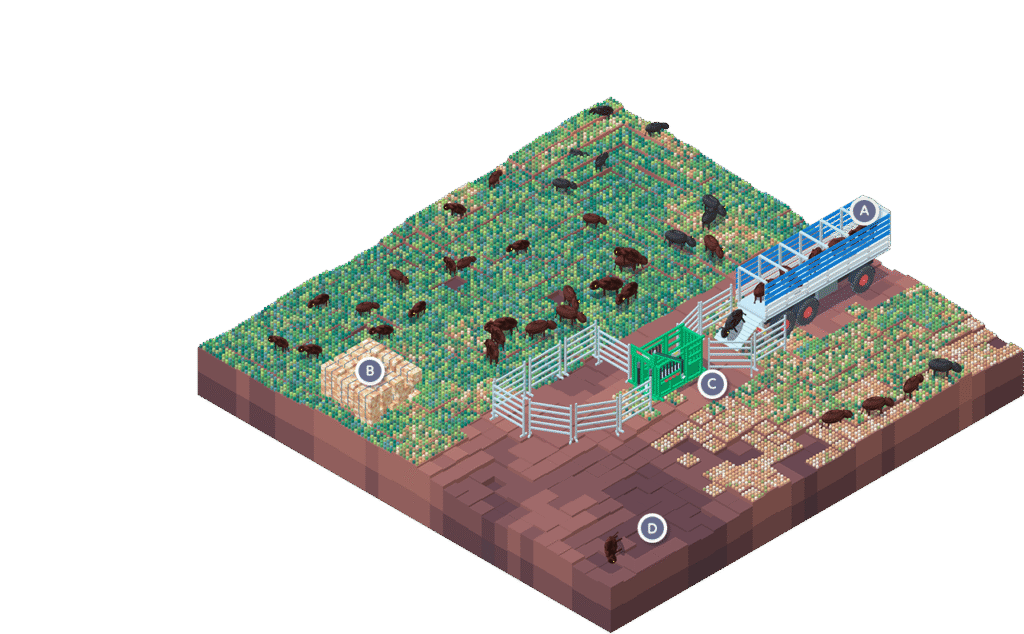

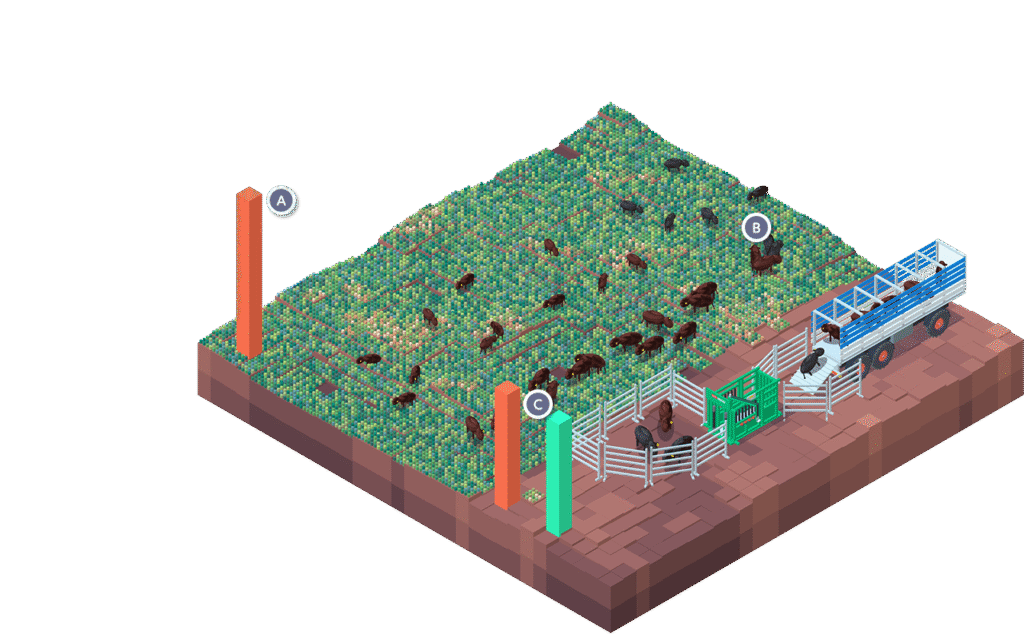

We’re proud to back Scotty and Tia of Bonkonia Beef, first-generation farmers with a reputation for top-quality beef in their local community. Our partnership has helped fund key inputs like fodder and seed, and supported herd growth to meet rising demand. If you’ve tasted their product you’ll agree, it’s truly beef worth bragging about!

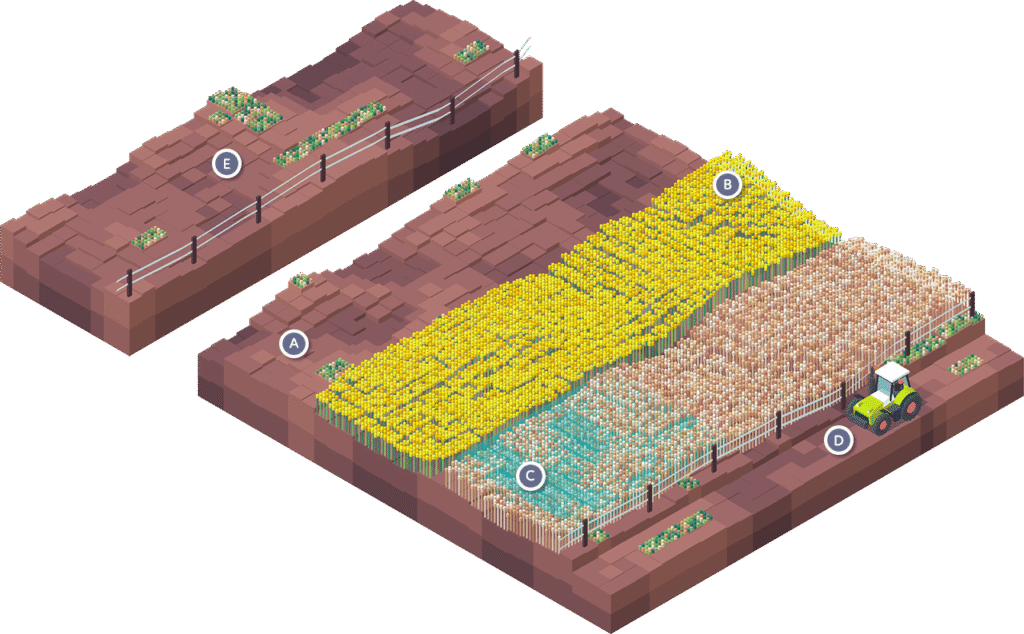

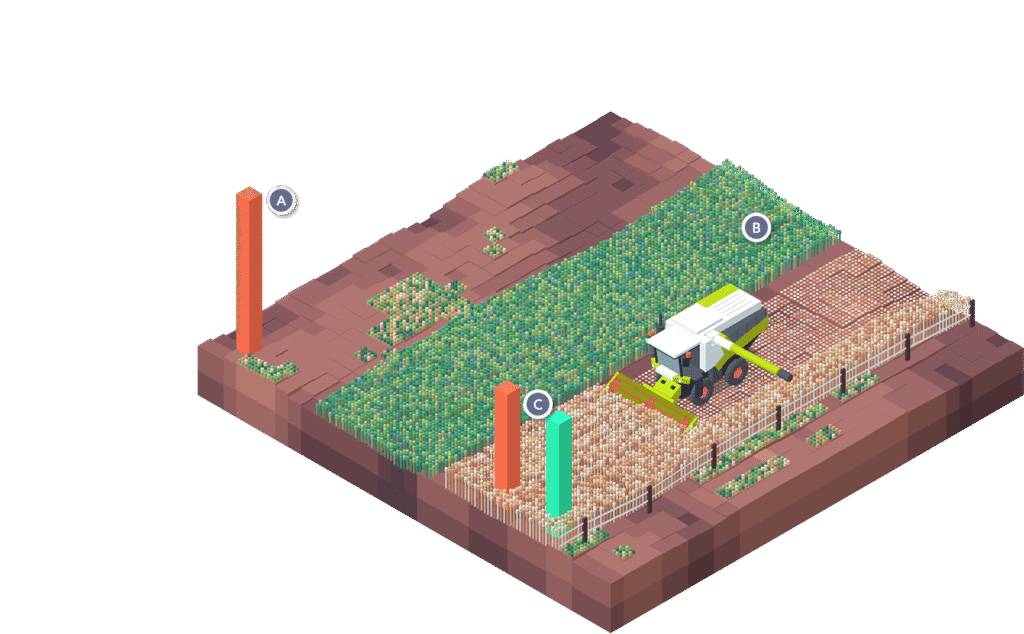

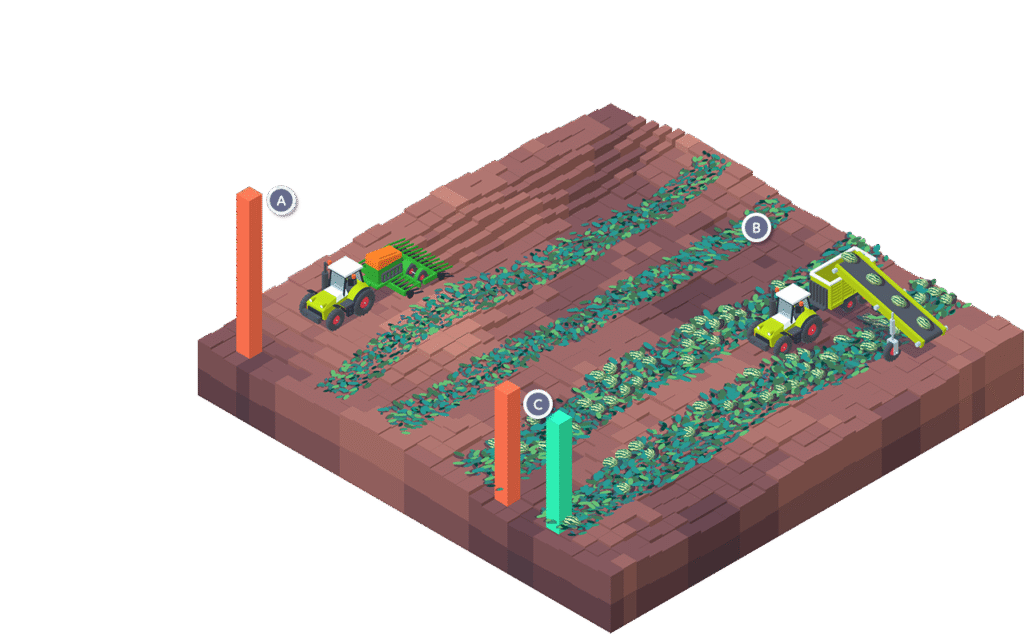

We partnered with Joe Ross on his wheat, beans, and barley programme, providing the cash flow needed to expand operations and navigate a run of tough seasons. The support gave Joe the confidence to seize new opportunities and continue scaling his business, all while reducing financial and seasonal pressure.

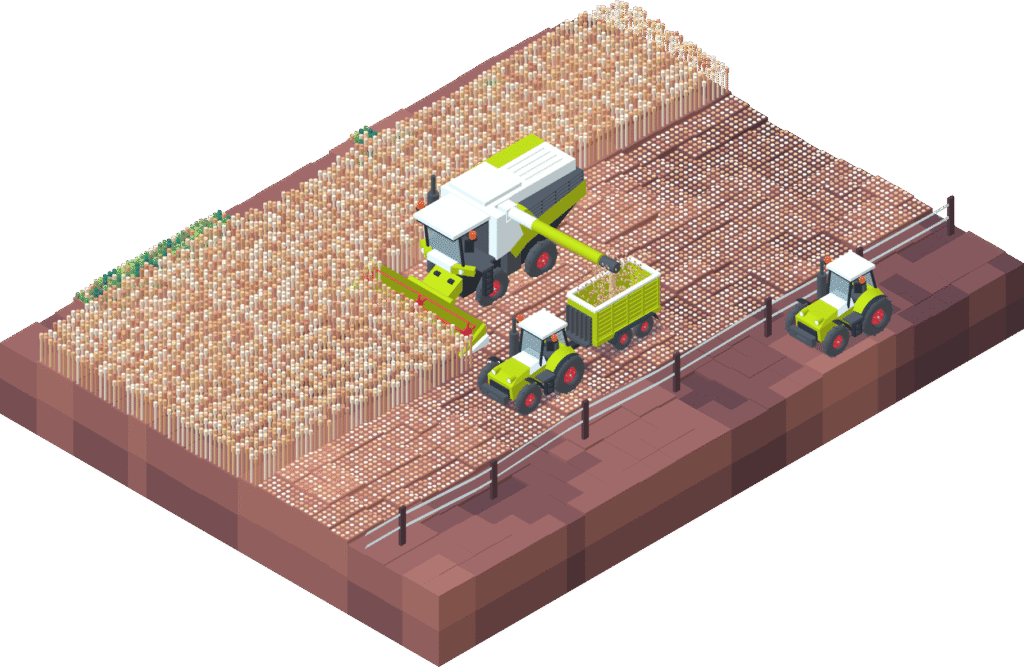

We partnered with CA & MD Williams to support their silage season, providing early cash flow to ease the pressure at the start of their cycle. The partnership not only helped them stay on track when a key buyer pulled out last-minute, but also connected everyday Australians with life on the land — something they’re passionate about sharing.

We partnered with RRR Rural on their mixed breed heifer programme, providing upfront cash flow that helped them manage risk and maintain momentum, regardless of seasonal or market shifts. The support gave them the confidence to keep growing their operation while connecting more city-based investors with life on the land.

We partnered with Declan Patten of Lightning Ridge Genetics to support his advanced dairy genetics program. By backing the purchase of recipient heifers and resulting calves, we’ve helped Declan fast-track his embryo transfer operations and bring high-performing milking cows and stud cattle to market. The flexibility and speed of funding have enabled him to act quickly, freeing up time to focus on innovation and growth.

We partner with James Family Agriculture on their grain-fed heifer program, backing the production of premium beef for their direct-to-consumer brand, JaWsome Produce. Our support helps them act on market opportunities when cash flow is tight, giving them the confidence to scale without delay.

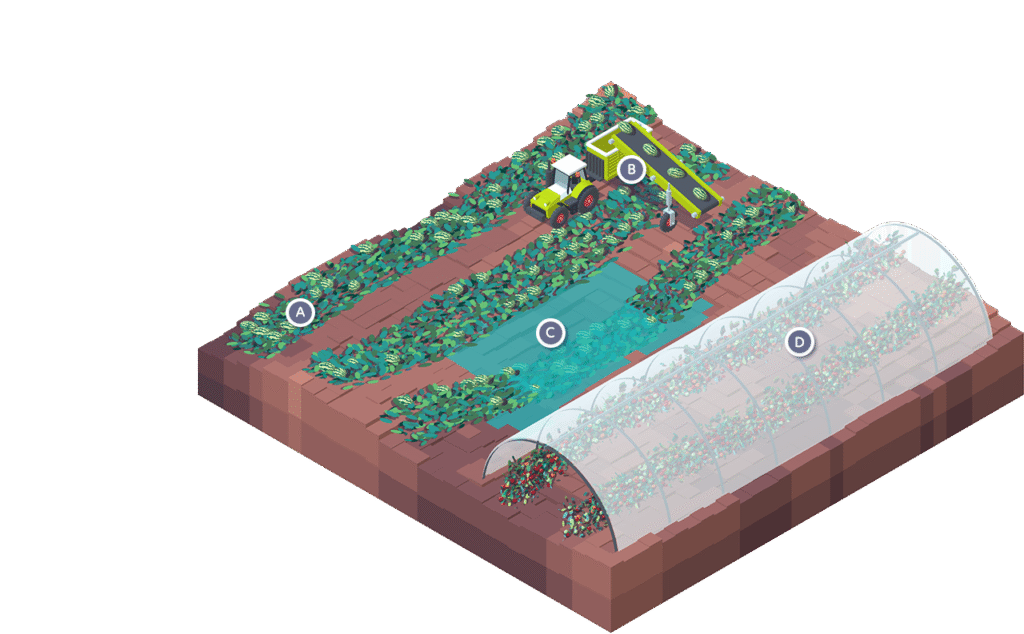

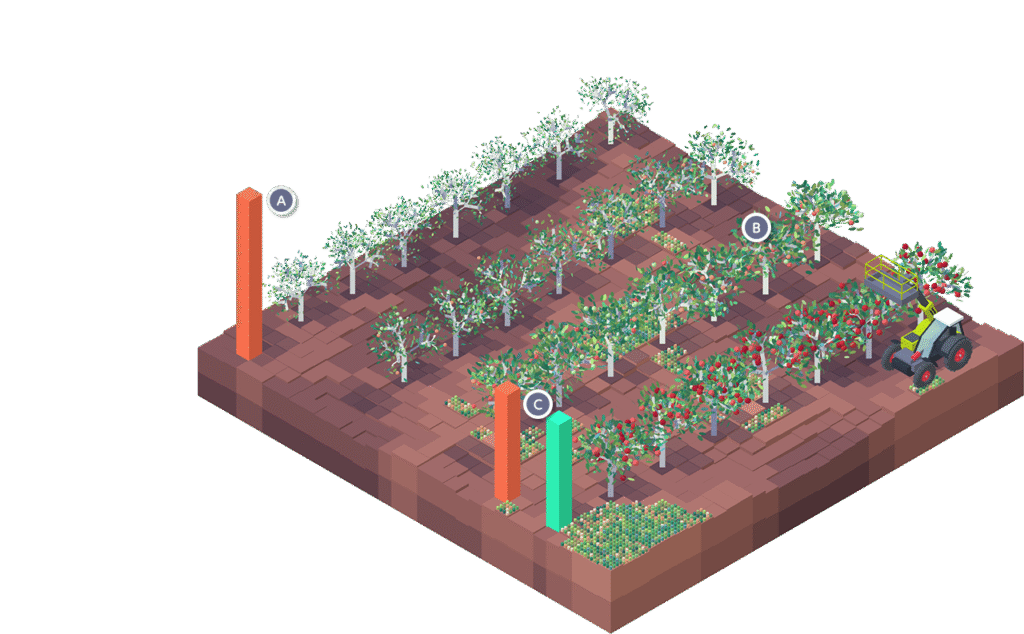

Embarking on pecan tree cultivation comes with financial challenges, particularly the lengthy turnover cycle. IIF’s timely capital injection transformed our trajectory, allowing us to kickstart a second cycle a year earlier than anticipated. This acceleration not only expedited returns but also showcased IIF’s understanding of our industry’s nuances.

We made available 4000 trees to farm share and were sold out in a record time.

Their swift financial support goes beyond mere capital provision; it’s a strategic partnership that propels businesses forward. For farmers seeking a reliable ally in navigating the complexities of farming, IIF stands out as a catalyst for accelerated growth. Grateful for their support, we confidently recommend IIF to fellow visionaries.

IIF is an incredible opportunity for the agricultural sector to reduce their risk and for a new, small business such as ours, provides the capacity through improved cashflow to grow the business.

IIF also enables us to develop a strong connection with a new client base who are now sharing our journey. Innovation in farming is constant and I believe IIF will be an integral part of the Australian Agricultural landscape as it evolves and grows. We look forward to continuing to be part of IIF in the future.

In order to comply with the rules and regulations of our Cooperative, farmers must meet the following criteria:

If this describes you, then you meet the criteria to partner with IIF.